Fund Vehicle Now Available

dormouse Fund

dormouse manages a systematic investment program trading futures in government bond, equity index, currency, commodity and short-term interest rate. A diverse set of investment strategies achieve high returns uncorrelated with major asset classes and benchmarks.

(Financial investments, hedge funds and managed futures investments carry significant risk, including the loss of some or all of the invested amount, and have limited liquidity.)

Previously, it was only possible to invest in this trading program through a separately managed account. dormouse is pleased to announce that it is now possible to invest via a Cayman offshore fund vehicle. The fund offers monthly liquidity.

Class "A" shares offer 1/20 fees and a low $1M minimum.

For a limited time, we are offering class "B" shares with a lower 1/10 fee structure and a $10M minimum investment.

If you would like more information

ABOUT US

An “Alternative” Alternative Investment Manager

Founded in 2011 by Dr. Martin Coward, dormouse uses rigourous scientific methodologies to test and develop rule-based strategies for investing in global financial markets, i.e. Quantitative Finance.

Dr. Coward, an internationally recognised pioneer of European quantitative hedge funds, co-founded IKOS in 1992 where, until his resignation in December 2009, he was Chief Investment Officer and Chairman. IKOS' unique trading strategies developed and directed by Martin enabled it to become one of the most successful hedge funds in the world, with peak assets of $3.5bn.

dormouse, Martin Coward's new venture is regulated and based in Malta.

MEET THE TEAM

The co-founders of dormouse have all worked together previously and have significant experience in building, fault-tolerant trading systems capable of transacting hundreds of thousands of trades daily.

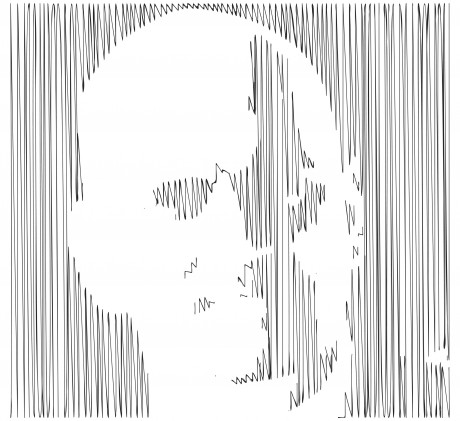

Martin Coward

FOUNDERDr. Martin Coward has over three decades of experience in trading, execution and risk management. After gaining a first class mathematics degree and Ph.D. from Cambridge University... read more

George Dowdye

GENERAL MANAGERGeorge Dowdye has been working as a financial services professional for nearly three decades. He started in investment banking with Barclays de ZoeteWedd Limited in the UK in 1990... read more

Hans Drescher

PORTFOLIO MANAGERDr. Hans-Joachim Drescher has a PhD in Theoretical Nuclear Physics from the University of Nantes in France. He has worked in several post-doc positions doing research... read more

Eric Westphal

dormouse Nest LP (USA)Dr. Eric Westphal has been working in finance for two decades. Upon leaving academia with a Ph.D. in Theoretical Particle Physics and Cosmology from Caltech in 1998... read more

STRATEGY

Our process is strategy evolution. We continually develop “Uncommon Models” and implementation of fast model prototyping using Python.

The portfolio construction involves an aggregation of alpha according to strategy weights, scaling to the target risk of the portfolio, and heuristic control of trading cost/slippage through ‘LazyTrader’ which intelligently reduces trading whilst preserving alpha. dormouse has a low allocation to interest rates and relatively low correlations with trend following strategies, equity markets, and commodities.

(Financial investments, hedge funds and managed futures investments carry significant risk, including the loss of some or all of the invested amount, and have limited liquidity.)

Trade execution involves continuous daily trading, FIX messaging protocol and liquidity provision in the limit order book. There is no opportunity for there to be a manipulation of the order book with ‘rogue’ or ‘phantom’ orders and there are no “ultra” high frequency methods.

Risk management is fully automated using a balanced approach to combine robustness with adaptivity. Our portfolio risk fluctuates closely around the average annualised risk level, risk scaling using an adaptive co-variance matrix. Risk is managed both within strategies and for the portfolio as a whole. The margin to equity is higher than average for the risk level due to the fact that a significant proportion of our trades are spreads.

SERVICES

dormouse Fund

dormouse manages a systematic investment program trading futures in government bond, equity index, currency, commodity and short-term interest rate. A diverse set of investment strategies achieve high returns uncorrelated with major asset classes and benchmarks.

(Financial investments, hedge funds and managed futures investments carry significant risk, including the loss of some or all of the invested amount, and have limited liquidity.)

Previously, it was only possible to invest in this trading program through a separately managed account. dormouse is pleased to announce that it is now possible to invest via a Cayman offshore fund vehicle. The fund offers monthly liquidity.

Class "A" shares offer 1/20 fees and a low $1M minimum.

For a limited time, we are offering class "B" shares with a lower 1/10 fee structure and a $10M minimum investment.

Managed Accounts

dormouse offers institutional investors access to the dormouse futures program through managed accounts. Managed accounts provide the institutional investor with increased transparency, flexibility and control allowing the investor to choose the funding level of the investment (notional funding) and the potential for customisation of both risk level (volatility) and liquidity frequency. The same signals are used for both managed accounts and fund vehicles.

CONTACT US

Investor related enquiries: ir@dormouse.com

General Enquiries: info@dormouse.com

Media Enquiries: media@dormouse.com

Recruitment Enquiries: recruitment@dormouse.com or go to careers

dormouse Limited

Victoria Mansions, Block 3 Suite 4B

Pjazza Toni Bajjada, Naxxar NXR2592

Malta, EU

+356 2733 3094

info@dormouse.com